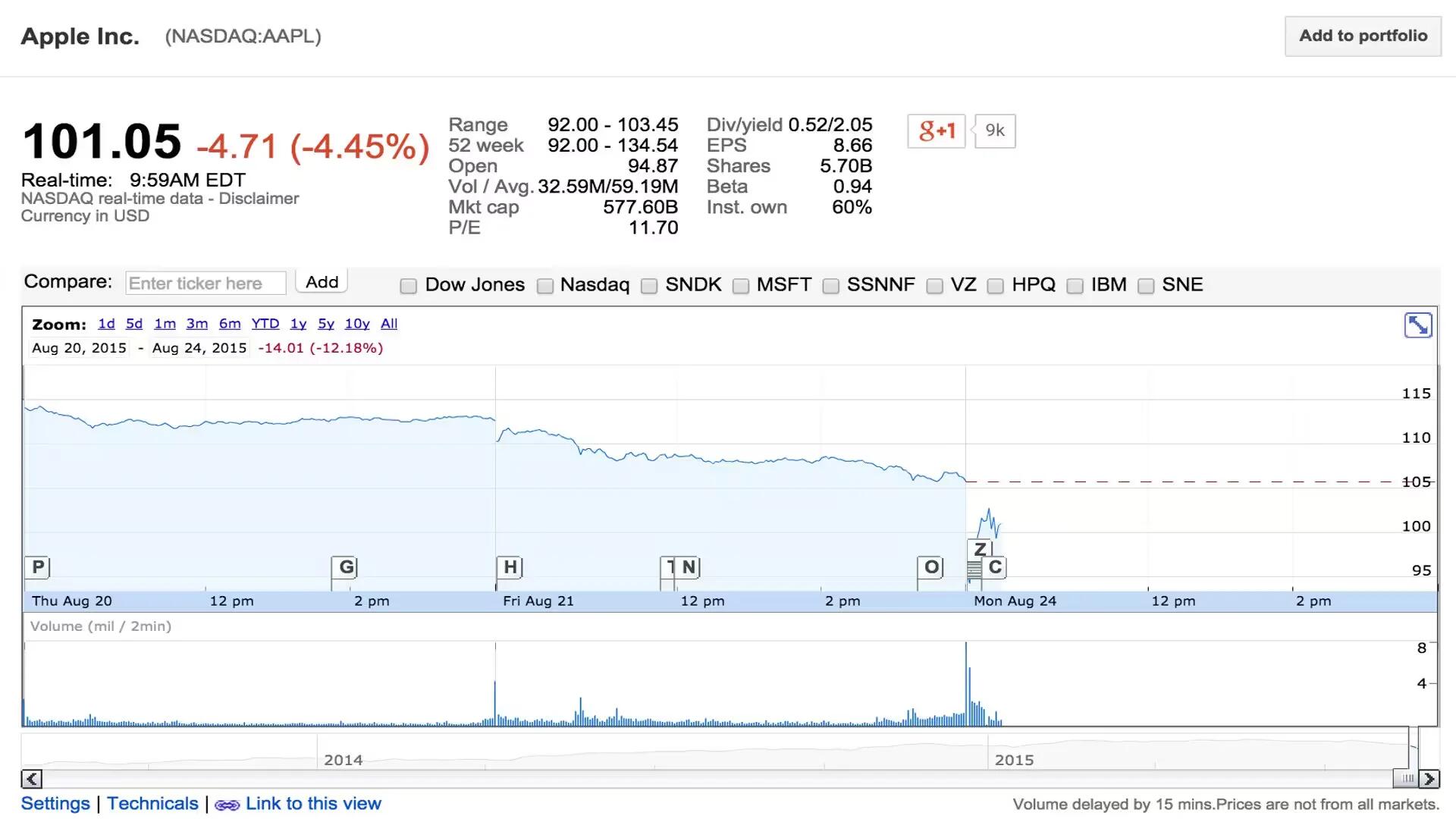

Today, Apple stocks has opened below $100 in the first minutes of trading, as investors are concerned that fall in growth in China will have impacts on company performance around the world.

Apple’s stock officially opened at $95.12 but has corrected slightly upwards since to circa $101. The fall in share price saw Apple’s market capitalization lose about $60 billion dollars in value today.

The whole market is down with losses across the board: the S&P saw a 5% overall fall – the largest one-day drop for four years. Technology stocks are being affected as much as any other sector. Twitter, Alibaba, Tesla and Netflix all saw falls in the double digits.

Market is open:

FIT: -17%

NFLX: -17%

TSLA: -13%

BABA: -13%

TWTR: -11%

FB: -11%

AAPL: -9%

AMZN: -8%

GOOG: -7%

MSFT: -5%— Neil Cybart (@neilcybart) August 24, 2015

The main reason for the stock fall is knock-on effects from China. For Apple, the fall in stock is due to speculations that the faltering Chinese economic growth might affect the sales of Apple devices.

Apple continues to tell investors that they are seeing strong sales growth for their products. Earlier today, Tim Cook emailed CNBC financial reporter Jim Cramer with rare comments on Apple sales outside of normal quarterly financial reports. In the email, Cook said iPhone activations actually accelerated in the last few weeks.

Time will tell whether the fears of Chinese economic collapse will come true. However, we can be sure that the whole market will remain volatile in the coming days.